Disclaimer: This article is only for information purposes. Laws can be changed quickly. We are not a tax advisor. We recommend you visit a tax advisor for a secure consultation.

Binary options trading can be an exciting financial pursuit, but it is not without its tax implications. The way binary trading is taxed varies from one country to another, and it is crucial to understand how it works in your specific location.

In this article, we will simplify the complexities and explore how binary options trading is taxed in different countries. We will provide the insights you need to navigate taxation rules in your country, whether you are a seasoned trader or just getting started.

Most important facts about Binary Options Taxation:

- Binary options taxation differs worldwide, classified as capital gains, income, or gambling in different countries.

- Tax Rates vary, from short-term capital gains in the USA to flat rates in India. Accurate record-keeping is vital.

- Tax Reduction Strategies mean that you should offset gains with losses, consider long-term holds, and account for deductible expenses.

- Due to the complexity of binary options taxation, always consult a tax expert in your region.

What are Binary Options taxes?

Binary options taxes refer to the taxation regulations and requirements governments impose on the profits earned through binary options trading. These taxes can vary significantly from one country to another and may depend on the specific circumstances of the trader.

In some countries, binary options profits may be subject to income tax, capital gains tax, or other forms of taxation. However, there are also places where binary options trading is not subject to any tax obligations.

Traders must understand the tax implications of their binary options trading activities in their respective jurisdictions and comply with the tax laws and reporting requirements.

Different tax rules in different countries:

The tax for Binary Options is different from country to country. Also, keep in mind that in a lot of countries, Binary trading is banned. Here we summarized the taxation:

USA

In the United States, binary options taxation is influenced by various factors. To begin with, if the expiration period is less than 12 months, the income is categorized as a short-term capital gain.

Short-term gains are subject to taxation at regular income tax rates, which range from 10% to 37%. For trades that expire after a year, they are typically considered long-term capital gains and fall into one of three tax brackets: 0%, 15%, or 20%.

It is worth noting that tax brackets can differ depending on your filing status, such as head of household, married filing jointly, married filing separately, or single. If your trading profits exceed $600 within a fiscal year, it is mandatory to file a tax return with the IRS.

Each trader has the option to offset up to $3,000 of losses against their total income. For instance, if your trading returns amount to $6,000, but you incurred $3,000 in losses, you will only be taxed on the net profit of $3,000.

UK

Prior to 2018, binary options were considered a form of gambling in the UK, and any generated revenue remained tax-exempt. However, with the subsequent regulation of binary options and the banning of retail trading by the Financial Conduct Authority (FCA) in 2019, the taxation rules for UK-based traders have become ambiguous. Consequently, seeking guidance from a qualified tax advisor is highly recommended in this complex landscape.

Canada

In Canada, profits obtained from binary options trading come under capital gains for tax purposes. Consequently, these gains do not fall under your regular income tax allowance. Notably, only 50% of the realized capital gains are subject to taxation. Additionally, losses incurred within a fiscal year can be subtracted from your gains, ensuring that only the net trading profits are subjected to taxation.

The specific tax amount owed differs based on the province of your residence. You can refer to the ‘taxes’ section on your provincial government’s official website for more information and guidance related to tax matters.

India

The taxation of binary options in India follows a relatively straightforward approach. Binary options are regarded as speculative products, and their profits are subject to taxation under a distinct set of regulations separate from regular income sources. Specifically, a flat-rate tax of 30% applies to speculative gains, including any associated fees or surcharges.

Australia

If you are uncertain about the tax implications of binary options trading in Australia, it is essential to note that the regulations remain uncertain. Presently, binary options have been banned following the introduction of an 18-month ban by the Australian Securities and Investments Commission (ASIC) in May 2021.

In September 2022, the ban was extended until October 2031 to protect retail binary options traders from further losses. The specific tax rules and guidelines that will apply after that date remain unknown.

Europe

Financial regulations imposed by the European Securities and Markets Authority (ESMA), such as MiFID and MiFID II, set limitations on the advertising and trading of binary options across Europe.

Although the ban has not been lifted, certain countries still maintain restrictions on platforms offering binary options to retail investors forever. It is worth noting that the taxation of binary options varies from one nation to another.

France

While active advertising of binary options is restricted in France, they can still be legally traded. At present, profits generated from binary options trading are categorized as capital gains and are subject to a fixed tax rate of 30%. It is important to note that this tax rate remains consistent and is not influenced by your regular income tax bracket.

Spain

In Spain, profits earned from trading financial instruments, including binary options, are typically subject to capital gains tax. The tax rate for capital gains varies based on the type of asset and the duration of the investment.

If you are a resident binary options trader, the applicable capital gains tax rates in Spain are as follows:

- 19% on the first 6,000€ of profit.

- 21 % for earnings between 6,000€ and 50,000€.

- 23% for profits exceeding 50,000€.

Germany

In Germany, if you accumulate profits amounting to €1,000 within a fiscal year through binary options trading, you are obligated to remit a fixed tax rate of 25%, accompanied by a supplementary surcharge.

Additionally, Germany’s financial regulatory authority, BaFin, extended the ban on binary options trading for resident traders in 2019, following ESMA’s initial ban in 2017. Traders who wish to avoid this ban can register with foreign brokers.

Italy

There has been considerable debate within Italy regarding whether binary options should be categorized as gambling. If classified as such, it would imply that any resulting profits might be subject to a 20% tax rate, aligning with the taxation of casino gambling. However, as of now, only investment firms or banks have the legal capacity to engage in binary options trading.

Additionally, Italy’s financial regulatory authority, CONSOB, has declared that it is against the law for customers residing in Italy to engage in trading with offshore brokers. While enforcing this prohibition may present challenges, prospective investors should be mindful of these regulatory guidelines.

Brazil

Earnings from binary options trading in Brazil are commonly considered capital gains and subject to corresponding taxation. The tax rate depends on the investment duration and profit amount, with short-term gains taxed at higher rates than long-term gains.

Prior to 2017, the tax rate was fixed at 15%, but now it can range from 15% to 22.5%, depending on how much profit you make.

Mexico

Gains from binary options trading in Mexico are generally considered taxable income. If you earn a profit from trading binary options, you may be required to report that income and pay taxes on it. The precise tax regulations and rates may differ based on your total income, investment duration, and the relevant tax legislation in Mexico.

It is essential to consult with a tax professional or the Mexican tax authorities to get precise information on how binary options profits are taxed in Mexico. Tax regulations for binary options are currently unclear, and the exact rules may vary based on your circumstances.

Singapore

Singapore offers a beneficial tax framework for Binary options traders. The Inland Revenue Authority of Singapore (IRAS) classifies Binary options trading as a speculative pursuit, resulting in gains from Binary options trading being exempt from income tax. This exemption serves as a notable advantage for Binary options traders in Singapore, allowing them to retain a more substantial portion of their earnings.

However, it is essential to recognize that this tax relief applies exclusively to individuals who engage in Binary options trading as a pastime or supplementary source of income. Should you choose to pursue Binary options trading as a full-time occupation or primary source of livelihood, it will be regarded as a business activity, and your profits will be subject to taxation.

Malaysia

If you are not classified as a professional trader, your Income Tax responsibility is determined using a progressive scale. Your tax rate will vary from 0% to 28% in Malaysia, depending on your total income over a 12-month period. Any gains accrued from binary options trading are considered a component of this income and are required to be disclosed.

Consequently, it is paramount that you keep a thorough record of all your trading activities, regardless of whether they resulted in a profit or loss. Failure to comply with tax regulations can result in significant financial penalties, including a fine of 20,000 MYR and an amount equal to 300% of the undeclared tax owed.

How to fill your binary options taxes:

Filling out your taxes related to binary options trading can be complex, as it varies by country and individual circumstances.

The steps are as follows:

- #1 Keep records: Maintain detailed records of your binary options trading, including trade details and outcomes.

- #2 Determine tax status: Understand if your trading profits are taxable in your country and how they are categorized (capital gains or income).

- #3 Gather documents: Collect tax-related documents from your broker or exchange.

- #4 Report income: Include your trading income in your annual tax return.

- #5 Consult a professional: Seek advice from a tax professional or accountant familiar with your country’s tax laws.

- #6 Pay taxes on time: Make sure to pay any owed taxes promptly to prevent incurring penalties.

- #7 Stay well-informed: Keep yourself updated on any changes in tax laws specific to your region.

How to reduce taxes?

Reducing taxes for binary options trading can be challenging, but there are some strategies that traders can consider to minimize their tax liability. Remember that tax regulations differ from one country to another, so it is essential to seek guidance from a tax expert familiar with the tax laws applicable in your specific region.

Here are some general strategies that may help reduce taxes:

Offset Gains with Losses: In many tax systems, you can offset capital gains with capital losses. If you have losses from specific trades, consider offsetting your binary options trading gains against those losses to reduce your overall taxable income.

Hold Investments Long-Term: Some nations provide reduced tax rates for long-term investments as opposed to short-term trading. If your country has a preferential tax rate for long-term capital gains, consider holding winning binary options trades for a longer period.

Consider Deductible Expenses: You can deduct specific trading-related costs, such as platform fees or educational materials, depending on your location. It is essential to record these expenses and consult with tax professionals if you have any uncertainties.

Get expert advisors for tax laws

Dealing with the taxes related to binary options trading can be tricky. It is a good idea to talk to a tax expert who knows the rules in your area. They can give you personalized advice and make sure you are doing the right things when it comes to reporting your taxes.

Conclusion – Seek professional advice when necessary

In summary, the taxation of binary options trading varies from country to country, with different regulations and tax codes in place. Traders should stay informed about their specific country’s tax rules, as they can be classified as capital gains or speculative gambling, each with its own tax rates and reporting requirements.

Staying updated on tax laws, seeking professional advice when necessary, and adhering to legal boundaries while managing your financial portfolio through binary options trading are crucial.

Frequently Asked Questions FAQs about Binary Options Taxation:

Where can I access information about paying taxes on binary options?

You can typically find guidance on binary options tax regulations and obligations on your country’s tax office website. Consider consulting a local tax advisor for clarification if you find the information unclear or confusing.

How can I fulfill my tax obligations for binary options trading in India?

Visit the official website of the Indian tax authorities to find complete guidance on fulfilling your tax responsibilities. On their website, you will see a dedicated section titled ‘Online Tax Payment,’ which includes a link to the tax return form. Follow the steps on the screen to securely input your personal information and payment details.

Is there a requirement to pay taxes on the income generated from binary options trading?

In most countries, binary options are treated similarly to traditional trading instruments, and individuals are typically subject to either standard income tax or capital gains tax. However, it is essential to note that in some countries, binary options are considered gambling, resulting in tax-free profits.

However, this has not diminished interest in digital trading options. In this article, we will explain to you how to trade and invest in Binary Options if you are from the Philippines and make clear research about its leaglitay status.

A step-by-step guide to trade binary option in the Philippines

What you will read in this Post

#1 Pick an available binary options broker in the Philippines

Utilize broker evaluations, a variety of comparison tools, and other resources to select the best binary trading platform for you. Options fraud used a serious problem. Binary options were used by unlicensed and dishonest traders as a new exotic commodity. These businesses are disappearing as a result of regulators taking action, but traders still need to look for registered brokers. Binary options Philippines-based traders can use any of the following brokers:

100+ Markets

- Min. deposit $10

- $10,000 demo

- Professional platform

- High profit up to 95%

- Fast withdrawals

- Signals

100+ Markets

- Accepts international clients

- High payouts 95%+

- Professional platform

- Fast deposits

- Social Trading

- Free bonuses

250+ Markets

- Crypto options

- Multiple payment methods

- High profit up to 88%+

- User-friendly interface

- Personal support

- Fast registration

100+ Markets

- Min. deposit $10

- $10,000 demo

- Professional platform

- High profit up to 95%

- Fast withdrawals

- Signals

from $10

(Risk warning: Trading is risky)

100+ Markets

- Accepts international clients

- High payouts 95%+

- Professional platform

- Fast deposits

- Social Trading

- Free bonuses

from $50

(Risk warning: Trading is risky)

250+ Markets

- Crypto options

- Multiple payment methods

- High profit up to 88%+

- User-friendly interface

- Personal support

- Fast registration

from $ 10

(Risk warning: Your capital can be at risk)

Quotex

On the platform, Quotex has been able to offer all of the trading tools that are effective and simple to use. Indicators, graphic tools, charts, sophisticated financial products, deposit and withdrawal methods, and other features are all included on the site so that each user may find what they need. A digital options broker featuring a user-friendly web-based platform is Quotex.

Additionally, it provides copy trading and a signals service. The minimal deposit amount for this brokerage is just $10. Fund withdrawal costs apply, and Quotex Philippines also offers a tempting 30% sign-up incentive. As a result, trade among Filipinos is relatively simple.

Features

- Accepts international clientele

- Minimum deposit is $10

- $10,000 demo

- A reputable platform

- Significant profit, up to 95%

- Quick withdrawals

(Risk Warning: Your capital can be at risk.)

Pocket Option

Online brokers for binary options and forex trading are both available through Pocket Option. Through web-based tools, mobile applications, or MetaTrader 5 software, traders have access to more than 100 trading resources. The company that runs “Pocket Option” is Gambell Limited Company, and its registration number is 86967.

Its address is the Trust Company Complex, which is on Ajelteke Road in Ajelteke Island, Majuro, Marshall Islands. Their professional experience indicates that it is a trustworthy offshore broker for investing in many marketplaces.

Features

- A reliable and secure platform

- $50 is the minimum deposit

- A $10,000 free demo account

- More than 100 distinct assets

- 24/7 trading

- High return of at least 95%

- Support for several languages

- Cash-back initiative

- Bonuses

(Risk Warning: Your capital can be at risk.)

Focus Option

One of the broadest collections of digital contracts for crypto is provided by Focus Option. Along with a large selection of new tokens and stablecoins, they provide access to Ethereum (ETH), Bitcoin (BTC), and Ripple (XRP).

With a $10,000 demo account balance, new traders can evaluate the broker’s offerings. A real-money account can also be opened by investors with a minimum deposit of $10.

Four account tiers are available. Additional benefits are available to traders who are active. These include quicker withdrawals and deposits, real-time market indications, and access to VIP events only available to members.

Features

- One-click trading

- Turbo binary options

- $10 minimum deposit

- Up to 90% in payouts

- Cryptocurrency payment options

- Low latency connectivity

- A wide range of cryptocurrency binary options

(Risk Warning: Your capital can be at risk.)

#2 Sign up for a trading account

Since most websites request these data upon registration, they are often relatively common. Your first & last name, country of residence, selected currency, password, email address, and preferred payment method are all included.

In some circumstances, you may also be asked for the phone number, which will be used to either verify your identification or to contact assistance when necessary. Support over the phone has grown to be quite popular among binary options brokers, and these days many operators make use of it to give users of their services a quick, practical, and simple way to get in touch with the support team.

When you join up, some brokers will ask for your payment details, although this is less usual because many traders choose to utilize a demo account first.

(Risk Warning: Your capital can be at risk.)

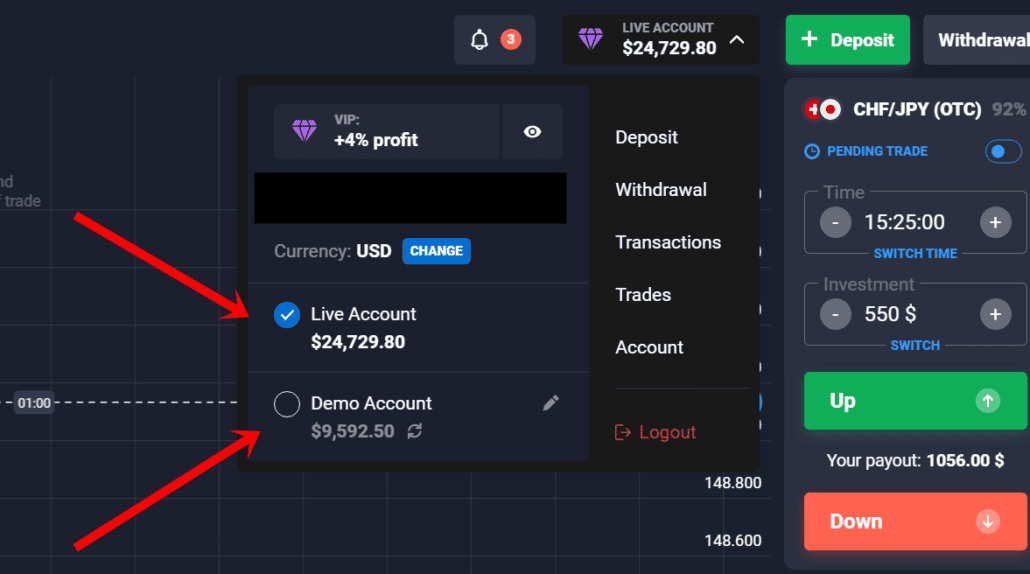

#3 Use a demo or live account

Demo accounts, which are available for free, are thought to be one of the finest methods to hone your trading abilities and try various trading techniques. Demo accounts generally function similarly to real money accounts, with the exception that you will be using virtual/demo money rather than actual money.

Trading using demo accounts is permitted by almost all binary options brokers, but in rare instances, you can find a broker that does not accept them. Because of this, it’s crucial to regularly review the features your broker offers.

If the trader has any past expertise, he can start trading right away on real accounts.

#4 Pick an asset to trade

Commodities, equities, cryptocurrencies, foreign exchange, and indexes are a few examples of assets. Consider the price of oil or Apple’s share price, for instance. Depending on the broker, different people can trade a different amount and diversity of assets.

The majority of brokers provide well-liked assets such as important stock indexes such as the FTSE, S&P 500, and Dow Jones Industrial, as well as famous currency pairs like EUR/USD, GBP/USD, and USD/JPY. Additionally, commodities like gold, silver, as well as oil are frequently offered.

Additionally, you may trade particular stocks and securities with several binary brokers. You are going to be able to select from a group of between 25 and 100 large stocks, such as Google and Apple, albeit not every stock will be offered.

#5 Make an analysis

You are ready to proceed once you have decided on an underlying asset. The major concern is whether the asset price will increase or decrease in the future. You must make this forecast. You’ll need to identify market patterns and apply indicators to examine the underlying asset in order to get the answer to this query.

To maximize your earnings, it is crucial to have a good approach. To generate trade ideas and create your trading strategy, use technical analysis. You can also benefit from the numerous educational resources that many Binary Options firms provide.

#6 Place the trade

Remember that the entire investment is at risk; thus, you should carefully examine the trading amount. The trader can now execute the deal after selecting an asset.

#7 Wait for the result

To make the deal, select Up / Call or Down / Put after determining your investment amount. Some brokers require an additional click in order for you to confirm the deal. It’s now time to wait for your trade to expire. Some brokers enable you to cancel deals before the expiration period has passed. By doing so, you can lessen the effects of a bad choice by doing so when the trade reaches a specific price.

What is a binary option?

Binary options are straightforward financial products with only two possible outcomes: winning or losing. You must make a direction prediction for an asset’s value, such as whether it will go up or down. In the event that you are right, you get a percentage as a return on the investment and win the deal. If you’re incorrect, you’ll lose all you invested. The nicest thing about them is how easy they are to use and how well they reduce risk because just the amount invested in the transaction may lose money.

With binary trades, users may also use leverage to increase their stakes. However, if you make an incorrect prediction, this can also enhance your loss, so you must exercise caution. Additionally, dependent on a set time range, binary options end when this point has been reached. This gives the trade more freedom and enables you to fit the transactions into the desired schedule.

Is binary trading legal in the Philippines?

Filipino traders of binary options are now treading carefully. Although binary options trading is regarded as unlawful, it continues to grow because of weak enforcement. Although it is impossible to predict the SEC’s position going forward, Filipino traders willing to take a chance should ensure they only work with licensed companies.

Payment methods for traders in the Philippines

Filipino traders do the majority of their deposit transactions via bank wires as well as credit/debit cards. The usage of digital wallets is not extremely common in the Philippines, although it is growing.

Bank wire

All Filipinos may do bank transactions using this approach, which is universal. The ability of banks in the Philippines to buy foreign exchange further encourages the usage of bank wires.

Credit/debit cards

Credit/debit cards provided by banks in the Philippines are not accepted by all binary options companies.

Digital wallets

International digital wallets like Skrill, Neteller, and Webmoney are growing in popularity among Filipino traders. The inclusion of various regional e-wallets, including WeePay DragonPay, JuanPay, PesoPay, PayEasy, Smart Money, and GCash, has contributed to its popularity in part. These regional e-wallets work with regional bank cards as well.

How to deposit and withdraw?

How to Deposit?

The ability to fund your trading account will be available to you once you have signed in to the account or created one. This will allow you to begin trading. Select “deposit” to add money to your trading account. When you do this, you will be able to choose from a variety of payment options, determine which one best matches your needs, and then input the amount you want to exchange.

How to Withdraw?

Make sure to be signed into the trading account before making a withdrawal. Select the Withdraw option. Upon clicking it, you will be presented with the various withdrawal payment methods that are supported by the platform. After making your choice, enter the withdrawal amount.

(Risk Warning: Your capital can be at risk.)

Pros and Cons

Pros

Free trading demo accounts

Brokers give you the option to establish free demo trading accounts with fictional funds. This enables novice traders to trade binary options risk-free using data that is current. It is a fantastic opportunity to practice the trading technique and become accustomed to this type of trading.

Trade Anywhere, Anytime

Traders have access to the world market whenever it is open from any location.

Risk and reward that are predetermined

Before entering a deal, consumers are well aware of the dangers and potential profits associated with binary trading.

Cons

Trading against the house

Binary options are comparable to sports betting in that the broker reveals bets, and you either win or lose. It is also important to understand that you are only betting on the progression of an underlying asset and that you do not own anything. The only thing that exists is a deal between yourself and the broker. The house always prevails, so keep that in mind!

A fraud risk

Be very careful to work with a reputable broker if you decide to trade binary options. There are numerous phony offers and brokers in this industry, which is highly vulnerable to fraud. Always exercise caution when dealing with websites or people that lure you with “100% guaranteed” offerings.

(Risk Warning: Your capital can be at risk.)

Risks of binary options trading

Market Risk

Trading binary options might come with general market risk, just like other types of investments. Markets may and frequently do move unexpectedly in different ways in almost all situations. Even the most detailed assessments cannot always forecast with absolute certainty which path the market will take, despite the fact that there are techniques to anticipate probable market moves.

Maximum/Fixed Profit Amount

Fixed gains are a danger that traders of binary options should be aware of. There is no limitless potential upside with these investments because both losses & gains are capped in the instance of these investments. But on the plus side, losses are also restricted.

Particularly Accurate Profit and Loss Points

Binary options are also assessed by the smallest tick, in contrast to many other investment instruments. This implies that the value of this kind of choice is frequently based on up to 3 or 4 decimal places. Even 0.0001 points can determine whether a trader is on the winning or losing side of an investment when trading binary options.

Illiquid

Additionally, binary options are not regarded as a “liquid” class of investment. Trading must thus wait until the options expiration date in order to realize gains or losses because these instruments cannot be executed at will.

Inability to Own the Underlying Assets

When traders start trading binary options, they are not fully making investments in ownership of any type of physical asset, as they are simply a wager on the price path of a fundamental asset. Others may see this type of investing as risky, even though it makes certain individuals feel secure.

Conclusion: Binary Options trading is available in the Phillipines

Although not available everywhere, binary options trading is rising in acceptance in the Philippines. Although all of these brokers are located outside and are governed by Filipino rules, there are introductory brokers available in the Philippines to assist you in trading more effectively.

Regardless of the broker you select, be sure you are aware of their rules and regulating body and that you are familiar with the services they provide. Consider all of your alternatives before settling on a broker if you reside in the Philippines since there are an increasing number of possibilities available.

(Risk Warning: Your capital can be at risk.)

Frequently asked questions about Binary Options in Philippines

Are binary options permitted in the Philippines?

As per the specifications of the Securities Regulation Code, binary options trading is forbidden in the Philippines.

Is binary options trading secure in the Philippines?

Trading binary options is currently not very secure in the Philippines. Numerous investors have complained to the SEC about losing money to foreign brokers. These losses certainly occurred on illegal broker sites. Many Filipino traders find it challenging to distinguish between licensed and unlicensed brokers since they both compete for the Filipino market.

Can I trade binary options with foreign brokers as a Filipino citizen?

Offshore binary options brokers are considered unauthorized organizations by the SEC in the Philippines. As a result, trading binary options with foreign brokers is forbidden in the Philippines. However, virtually little is being done to enforce the law to prevent local dealers from trading with foreign brokers.

Is PayPal a viable payment method for binary options dealers in the Philippines while utilizing binary options platforms?

Local binary options traders in the Philippines are unable to use PayPal.

The binary options trading sector in Mexico is still in its infancy but has promising future possibilities. The US political landscape has a significant impact on all markets (commodity, stock, currency, and derivatives markets), but the Mexican economy is gradually joining the global value chain. Being the ninth-largest oil producer in the world, Mexico’s markets are likewise influenced by crude oil prices.

A step-by-step guide to trade binary option in Mexico

What you will read in this Post

#1 Pick an available binary options broker in Mexico

Verifying the broker’s regulatory status is the initial and most crucial duty for traders. It is an essential element for traders to take into account. Brokers are supervised by well-known regulatory organizations, including ASIC, CySEC, and the Financial Services Authority (FSA), who also guarantee the safety of traders’ funds.

The fact that many countries do not regulate binary options is something to bear in mind. As a consequence, traders from certain nations are not able to buy or sell binary options with a local broker. They must instead seek an offshore broker that is authorized by a reputable body.

In order to ensure greater safety, it is crucial to engage with a licensed broker rather than one who is not. A reliable broker will offer you a fair price that is unaffected by market manipulation, ensuring that your cash is not in danger. Binary options Mexico-based traders can use any of the following brokers:

100+ Markets

- Min. deposit $10

- $10,000 demo

- Professional platform

- High profit up to 95%

- Fast withdrawals

- Signals

100+ Markets

- Accepts international clients

- High payouts 95%+

- Professional platform

- Fast deposits

- Social Trading

- Free bonuses

250+ Markets

- Crypto options

- Multiple payment methods

- High profit up to 88%+

- User-friendly interface

- Personal support

- Fast registration

100+ Markets

- Min. deposit $10

- $10,000 demo

- Professional platform

- High profit up to 95%

- Fast withdrawals

- Signals

from $10

(Risk warning: Trading is risky)

100+ Markets

- Accepts international clients

- High payouts 95%+

- Professional platform

- Fast deposits

- Social Trading

- Free bonuses

from $50

(Risk warning: Trading is risky)

250+ Markets

- Crypto options

- Multiple payment methods

- High profit up to 88%+

- User-friendly interface

- Personal support

- Fast registration

from $ 10

(Risk warning: Your capital can be at risk)

Quotex

A well-known, properly regulated brokerage having a preference for customer pleasure, Quotex is a prominent service for trading options and derivatives. Quotex has a reputation for creating infrastructure. It was a market innovator for binary options and contracts for differences backed by Bitcoin and other cryptocurrencies.

The brokerage Quotex concentrates on a small selection of assets yet consistently produces excellent results. Quotex provides forex options, indices, as well as commodities such as oil and silver, in contrast to a select few brokerages which offer a profusion of other choices and staggered purchasing tactics. It does, however, most significantly provide the ability to trade in four of the most significant cryptocurrency players: Ethereum, Litecoin, Ripple, and, most notably, Bitcoin.

Features

- Minimum Deposit: $10

- Account Types: Demo, Live

- Trading Platform: Web platform & Mobile platform

- Instruments: Currency pairs, commodities, indices, and cryptocurrencies

- Minimum Trade: $1

- Expiry Times: 1 minute to 4 hours

(Risk Warning: Your capital can be at risk.)

Pocket Option

One of the earliest trading platforms, Pocket Option, has a dedicated app for tracking trades. It has developed a reputation as a major participant in the financial industry over time. It ranks as one of the top three binary options brokerages on the market right now.

Pocket Option offers the most range of alternatives. More than 35 different cryptocurrencies, such as the rapidly expanding Bitcoin and Ethereum, are available on the site, along with currency, commodities, equities, and indexes.

Since it is a heavily leveraged participant with limited capital and must limit its losses due to the significant volatility and sharp price swings frequently associated with widely used cryptocurrencies, it gives a lower payment percentage when compared to other brokers. Furthermore, since Bitcoin is widely traded, it only gives a fair rate of compensation since it is a more reputable trading contract.

Features

- Regulation: By FCA, MiFID, and CySEC

- Minimum Deposit: $50

- Minimum Per Trade: $1

- Demo Account: Available

- Mobile Trading: Supported

- Instruments: Stocks, Crypto and Binary Options

(Risk Warning: Your capital can be at risk.)

Focus Option

As an offshore, unregulated brokerage, Focus Option Limited is a registered broker in St. Vincent and the Grenadines. The brand places a lot of emphasis on CFDs and digital choices rather than standard options.

With a few exceptions, investors from all around the world can trade with brokers who provide their goods and services. The following nations are supported: Singapore, Kenya, Japan, Malaysia, Australia, the Philippines, Kenya, Singapore, and the United Kingdom. On Focus Option, there are more than 60 financial products accessible, including those for forex, cryptocurrencies, and commodities.

Features

- Instruments: CFDs, Forex, Indices, Metals

- Minimum Deposit: $10

- Minimum Trade: $1

- Payout: 95%

- Expiry Times: 30 seconds to 1 week

- Mobile Apps: iOS and Android

(Risk Warning: Your capital can be at risk.)

#2 Sign up for a trading account

There are a few things you’ll need to have ready before you begin the account opening process, regardless of the company or kind of account you select. Your basic personal information will be collected. This information does include the date of birth, social security number, and nature of employment.

You’ll be questioned about your attitude toward accepting financial risks as well as how long you anticipate holding the investments.

You don’t need to be anxious about whether or not your answers are precise to the percent or penny. This information is not needed to be verified or updated by brokers throughout your partnership. Even so, if your circumstances change and you wish to access new asset classes, you can always return to the site’s profile section and adjust your answers.

#3 Use a demo or live account

A demo account for binary trading isn’t just for newbies. Even seasoned traders often do demo tests. Your strategies will occasionally cease functioning as you anticipate. You could be making mistakes, the market may be shifting, there may be psychological variables at play, or there may be other, harder-to-nail-down causes.

Whatever the case, using a binary demo account lets you learn the ropes without incurring any more losses. After finding the problem, you may resolve it and resume profitable trading.

#4 Pick an asset to trade

You should pick a small number of assets and concentrate on knowing their particulars before trading on a live account after practicing how to trade various asset kinds on a demo account. However, most traders focus on a single asset class, industry, or market.

#5 Make an analysis

Indicators are used in binary options analysis to study market movements and are applied to charts. These indicators are used by binary options traders to scan the underlying markets for patterns and trends that they may use to guide their trading choices.

#6 Place the trade

It is one of the easiest financial assets to trade since traders make decisions based on whether they think the response is yes or no. This ease of use has made it very appealing to traders and newbies to the financial markets.

Even though binary options may appear straightforward, traders should completely comprehend how they operate, the markets and timelines they may trade in, the benefits and drawbacks of these commodities, and the businesses that are legally permitted to offer binary options.

A “range” binary option, however, lets investors choose a price band that the asset will trade in up until it expires. If the price remains within the range, a dividend is obtained; otherwise, the investment is forfeited.

(Risk Warning: Your capital can be at risk.)

#7 Wait for the result

Binary options offer a predetermined payout or nothing at all as a payment option if the contract is held to expiration. Traders will be aware of the results of their binary options trading once the deal has expired. There will be a rise or fall in the underlying asset’s value. If the binary options transaction matches the results of the trader’s expert analysis, they will probably be successful.

What is a binary option?

In recent years, traders have been increasingly interested in binary options as a financial instrument. Within a predetermined time frame, you can buy and sell on either long or short markets. Binary Options are unique in that there are just two options available to you as a trader, regardless of if you lose all of your money to one trader or receive a large, set payment of between 75 to 95 percent of your capital. You stake money on both rising and declining markets.

Binary Options are an extremely versatile financial tool since you may trade practically any asset for any amount of time. The time intervals typically range from 5 seconds to at least 1 hour.

Is binary trading legal in Mexico?

The crucial thing to keep in mind is that there is a distinction between legality and regulation with regard to binary options trading. Though most nations, including Mexico, permit such trading, it’s crucial to be aware that the nation’s financial markets are governed by a regulatory authority.

The Ministry of Finance and Public Credit in Mexico, also known as the Comisión Nacional Bancaria y de Valores (CNBV), is responsible for the decentralized National Banking and Securities Commission.

Payment methods for traders in Mexico

Here are some of the most typical deposit and withdrawal methods for trading binary options in Mexico:

- Electronic fund transfers

In Mexico, the SPEI and CCEN handle interbank and intrabank financial transactions. Unlike the latter, which is run by a private owner named CECOBAN, the former is owned and controlled by the nation’s central bank.

- Digital Wallets

In Mexico, payment processors like PayPal are also accepted. This is often a secure approach since such accounts are connected to bank accounts, which makes it simpler to confirm the trader and the broker. In fact, in an effort to improve the system’s efficiency and transparency, the Mexican government is encouraging the adoption of electronic payment methods rather than cash or checks.

- Online banking

Without relying on payment gateways or even plastic money, internet banking has become a practical method of conducting transactions, even when on the road. Online accounts can be funded directly through transfers and deposits.

- Credit & debit cards

Mexican banks like BanCoppel and Banco Azteca provide international credit cards like Visa, MasterCard, and American Express, which are also well-liked there.

(Risk Warning: Your capital can be at risk.)

How to deposit and withdraw in Mexico?

How to deposit?

You may fund your account in several ways, as was covered above. Various deposit options are available depending on the broker. Select the deposit page after logging into your account. Here, you may pick the most convenient way to add money to your account.

How to withdrawal?

Depending on how you made the deposit, most platforms will dictate how you make a withdrawal. If you fund your account with an e-wallet, you may only withdraw money back into the same e-wallet wallet. On the withdrawal page, you may make a withdrawal application to withdraw money. Depending on the broker, the withdrawal process takes a variable amount of time. Additionally, depending on where you are, conditions may change.

Pros and cons

The biggest benefits of investing in Mexican binary options are the chances for quicker growth than you could find with comparable U.S.-based firms and the opportunity to diversify outside of US corporations. There are advantages and disadvantages to investing in Mexican equities, as well as some general considerations before committing money.

Pros

Potential for rapid expansion

Mexican businesses may have a chance for outsized gains since they are a part of a rising market driven by cheaper labor and energy costs.

Diversification

There are hazards involved with investing in a single industry. Risks also exist when investing in a single nation on a larger scale. Mexican stock investing offers a distinctive sort of diversification that is not possible with simply U.S.-based investment types.

United States-Mexico-Canada Agreement (USMCA)

The NAFTA successor puts Mexico on an equal footing with more developed countries and is anticipated to be beneficial to Mexican businesses and employees, perhaps boosting the country’s total economy.

Cons

Financial risk

Although Mexico’s GDP growth has been largely consistent, the country’s economic growth unexpectedly went negative in the first quarter of 2019, serving as a warning that growth in emerging nations isn’t always assured.

Political hazard

Risk resulting from political variables can take many different shapes. Markets may be affected by uncertainty and government activities, which in the case of Mexico can either be measures taken by the Mexican government or those taken by the United States government.

Risks of Binary Options Trading

Currency risk

Investing in developing countries might involve currency risk, as transactions are made in pesos and subsequently translated to dollars, potentially lowering the value of the transaction owing to fluctuations in currency prices.

Liquidity risk

There are business areas that aren’t always straightforward to depart from, even on the greatest stock market in the world—the U.S. In emerging markets, where there may not be many customers available at a given price, this issue is even more prevalent. Liquidity risk is often decreased when investing in the equities of larger corporations.

No ownership of the underlying assets

Traders are not truly investing in possession of any kind of physical asset when they trade binary options because they are only a bet on the path of an underlying asset. While some people feel at ease with this kind of investment, others could view it as a possible danger.

(Risk Warning: Your capital can be at risk.)

Conclusion : Binary Options trading is available in Mexico

The article’s goal is to draw attention to the opportunities in the Mexican binary market as well as the elements that have the potential to be profitable. Additionally, it highlights some of the most prominent brokers, describes the current laws governing binary options in Mexico, and offers details on a variety of other elements of binary options trading there. Although there are many binary options brokerages to select from in Mexico, the most important thing is to pick one that is regulated.

Frequently asked questions about Binary Options in Mexico:

Are binary options legal in Mexico?

They are lawful, yes. They are starting to become more regulated, enhancing the transparency of the transactions. But the market is not yet structured.

Is trading binary options secure in Mexico?

Although trading binary options in Mexico could be secure, given that the market is still in its infancy and unstructured, there may be risks. Do your homework on the broker you want to choose.

In Mexico, is it possible to profit from binary options?

The Mexican Peso is incredibly erratic and presents prospects for financial success. One must, however, trade with knowledge of the dangers involved and make well-informed selections. Of course, you may trade a plethora of instruments besides the peso.

(Risk Warning: Your capital can be at risk.)

Exnova and Binomo offer traders investor-friendly trading conditions. They can use both brokers for a secure trading experience. If you’re just starting, you’ll find that you’re well-supported.

Choosing between these two trading platforms can be challenging. Both brokers are great at what they offer their clients. However, let us perform an Exnova vs. Binomo analysis to determine which broker strives to offer the best to traders.

Exnova vs. Binomo – Comparison

The following Exnova vs. Binomo comparison can help a trader decide which trading platform offers them the best benefits:

| Basis | Exnova | Binomo |

|---|---|---|

Rating (based on this review): Rating (based on this review): |

9/10 | 6.7/10 |

Auto trading: Auto trading: |

Yes | Yes |

Mobile application: Mobile application: |

Yes | Yes |

Customer support: Customer support: |

24×7 | 24×7 |

Minimum deposit: Minimum deposit: |

$10 | $10 |

Minimum trade: Minimum trade: |

$1 | $1 |

Demo accounts: Demo accounts: |

Yes | Yes |

Withdrawal fee: Withdrawal fee: |

Applicable after one free withdrawal every month | Withdrawal fee applicable on all withdrawals |

Features: Features: |

Technical tools, indicators, charts, etc. | Technical tools, indicators, charts, etc. |

Assets: Assets: |

250 | 75+ |

Account types: Account types: |

Real and Demo | Standard, Gold, VIP, and Demo account |

(Risk warning: Your capital can be at risk)

#1 Auto-trading

Exnova offers traders a bot that they can use for an automated trading experience. The Exnova bot helps traders place trades automatically. Similarly, there is a Binomo Robot that traders can use on Binomo for auto-trading.

Both trading bots are equally good. However, traders must be cautious while choosing these bots as they can sometimes scam traders.

| Basis | Exnova | Binomo |

|---|---|---|

| Rating (based on this review): | 9/10 | 9/10 |

| Auto-trading: | Available | Available |

#2 Mobile application/app download

Both brokers offer traders an ease of trading with the mobile application. The mobile application of Exnova is downloadable for Android and iPhones. The same is true for the Binomo app download. Traders can easily set up these trading applications on their phones to trade on the go.

Both mobile applications are free to use on all devices.

| Basis | Exnova | Binomo |

|---|---|---|

| Rating (based on this review): | 9/10 | 9/10 |

| Mobile app: | Available | Available |

| Devices: | iOS, Android | iOS, Android |

#3 Customer support

Both the Exnova support and the Binomo support are responsive and reliable. Traders have access to 24×7 customer support on both platforms. Customer support is available through live chat, email, etc.

So if a trader has any questions while trading on the platform, they can get support immediately. If you are looking for a trading platform that offers a seamless trading experience, both platforms can be suitable.

| Basis | Exnova | Binomo |

|---|---|---|

| Rating (based on this review): | 10/10 | 8/10 |

| Availability: | 24/7 | 24/7 |

| Friendliness: | Excellent | Good |

| Email support: | Yes | Yes |

| Live chat: | Yes | Yes |

| Phone support: | Yes | Yes |

#4 Minimum deposit

Binomo and Exnova have similar minimum deposit requirements. Traders are required to fund their trading accounts with a minimum of $10 at both brokers. So both trading platforms have low requirements.

Therefore, beginners can choose either of these two brokers if they are more concerned about choosing a broker with a low deposit amount.

| Basis | Exnova | Binomo |

|---|---|---|

| Rating (based on this review): | 9/10 | 8/10 |

| Minimum deposit: | $10 | $10-13 (depending on country of residence) |

#5 Minimum trade

The minimum trade value on both trading platforms is $1.

| Basis | Exnova | Binomo |

|---|---|---|

| Rating (based on this review): | 10/10 | 10/10 |

| Minimum trade: | $1 | $1 |

#6 Demo accounts

Exnova and Binomo offer free demo accounts. Traders can register for demo accounts by visiting the respective broker’s website. The registration process on both platforms is straightforward. Once traders sign up for demo accounts, they receive virtual funds that they can use to test the trading platforms.

| Basis | Exnova | Binomo |

|---|---|---|

| Rating (based on this review): | 10/10 | 10/10 |

| Demo account: | Available | Available |

| Virtual funds: | $10,000 – unlimited | $10,000 – unlimited |

#7 Withdrawal fee

Binomo does charge withdrawal fees to its traders. The withdrawal fee at Binomo is applied to each withdrawal that a client makes. See more about the conditions in the upper picture.

Exnova offers a free withdrawal every month. If a trader makes a subsequent withdrawal in the same month, he will be charged a 2% withdrawal fee. The withdrawal fees charged by Exnova are lower than the withdrawal fees charged by Binomo.

| Basis | Exnova | Binomo |

|---|---|---|

| Rating (based on this review): | 8/10 | 7/10 |

| Withdrawal fee: | Applicable after one free withdrawal every month | Applicable on all withdrawals |

#8 Features

Both trading platforms excel in providing traders with advanced trading features. Traders can enjoy using the platform with advanced trading tools. There are several indicators, charting features, etc. that both brokers offer.

Thus, traders can have the best trading experience on both platforms.

| Basis | Exnova | Binomo |

|---|---|---|

| Rating (based on this review): | 9/10 | 7/10 |

| Features: | Technical tools, indicators, charts, etc. | Less than on Exnova |

#9 Assets

The number of assets available on an online trading platform is also important to traders. The more assets a trader has access to, the better the chances of diversifying their trades.

Exnova is the leader in offering more assets than Binomo. Binomo only offers traders 75+ underlying assets. However, Exnova offers more than 250 assets. This makes Exnova a more suitable trading platform.

| Basis | Exnova | Binomo |

|---|---|---|

| Rating (based on this review): | 9/10 | 5/10 |

| Assets: | 250+ | 75+ |

#10 Account types

Binomo offers standard, gold and VIP trading accounts. Traders can choose an account type depending on the minimum deposit amount they wish to add to their trading account. However, traders only get one type of account at Exnova. This means that all traders can only use one type of account with the broker.

| Basis | Exnova | Binomo |

|---|---|---|

| Rating (based on this review): | 9/10 | 9/10 |

| Account types: | Real and demo | Standard, Gold, VIP, and Demo account |

What is Exnova?

Exnova is a highly-rated new online trading platform. The broker has only recently entered the trading world. However, it has attracted a huge clientele because of its amazing features.

Exnova offers a fully functional trading experience. Traders have plenty of options when it comes to choosing an underlying asset to trade. Exnova has excellent customer service. This makes trading more attractive.

You can enjoy several benefits when choosing Exnova as your preferred trading platform. Let us explore the main benefits offered by the broker.

Advantages of Exnova

Let us take a closer look at the advantages of Exnova.

- It offers traders a choice of 250 financial instruments. These include binary or digital options, stocks, commodities, indices, forex and more.

- The broker supports a powerful and advanced online trading platform. It has all the features that any experienced trader would want in a perfect broker.

- Traders have access to many technical tools for trading. For example, Exnova offers top charts, technical Exnova indicators, etc., for trading.

- The broker supports fast order execution. This means that a trader does not have to worry about missing out on investment opportunities.

- Traders need a small minimum Exnova deposit of $10 when trading with the broker

- Exnova allows traders to trade with any amount starting from $1.

- The broker has a large customer base due to its presence in many countries. It operates in multiple languages.

- Many resources on the platform are designed to help traders improve their trading skills.

- Exnova supports live chats, trading communities, etc. to help traders interact with each other.

- Traders can use advanced features to limit their losses.

- The broker offers stop loss and take profit features.

- The broker also supports fast withdrawals.

Registering with Exnova can provide traders with a unique trading experience. These features are what a trader needs to enjoy trading to the fullest.

Binomo offers traders similar features. Let us explore Binomo as we compare the two brokers on the most important parameters.

(Risk warning: Your capital can be at risk)

What is Binomo?

Like Exnova, Binomo is a platform where traders can buy or sell stocks, commodities, indices, etc. The platform has been serving traders since 2014. As a result, the broker has gained enough trust from traders to attract a large clientele.

There are several features available when using Binomo. This online trading platform operates in almost 133 countries. Binomo is available in several languages.

Unlike most brokers, this broker also has a very low minimum deposit amount for traders. Traders can fund their accounts with the broker for as little as $10. The fact that traders can place a trade with as little as $1 also shows that this is a beginner-friendly platform.

Advantages of Binomo

Now, let us take a closer look at the advantages of Binomo.

- Binomo has a simple user interface. This platform is easy to use for both beginners and advanced traders.

- Traders can start funding their trading account on Binomo with a minimum amount of $10.

- Binomo offers more than 70 different financial instruments. Traders have a good scope for trade diversification.

- The demo account offered by Binomo contains virtual funds available for learning how to trade. The demo account is for free.

- Traders can opt for different account types on Binomo, depending upon their trading expertise.

- Some account types offered by Binomo also allow traders to get bonuses.

- The broker provides a mobile application. The Binomo application is available for iOS and Android phones.

- The customer support accepts live chat, email and phone calls. Traders can get the response to their emails within one business day.

The features offered by Binomo show that it has very decent trading conditions for traders. However, traders may notice a few differences when using Exnova and Binomo.

We stop promoting and recommending Binomo anymore after banning our partner’s account for no reason. Choose a better alternative like Quotex or Pocket Option to trade!

Choose the best alternative to Binomo:

100+ Markets

- Accepts international clients

- High payouts 95%+

- Professional platform

- Fast deposits

- Social Trading

- Free bonuses

100+ Markets

- Min. deposit $10

- $10,000 demo

- Professional platform

- High profit up to 95%

- Fast withdrawals

- Signals

100+ Markets

- Accepts international clients

- High payouts 95%+

- Professional platform

- Fast deposits

- Social Trading

- Free bonuses

from $50

(Risk warning: Trading is risky)

100+ Markets

- Min. deposit $10

- $10,000 demo

- Professional platform

- High profit up to 95%

- Fast withdrawals

- Signals

from $10

(Risk warning: Trading is risky)

Conclusion: Exnova performs better in our comparison

Binomo and Exnova both have good trading conditions, but Exnova clearly outperforms Binomo in our comparison. Trading with Binomo can be a little expensive for traders. They would have to bear high withdrawal fees with Binomo.

In addition, the assets offered on Binomo are less than what traders get on Exnova. Traders can expect more features and better trading conditions with Exnova. A trader only needs to choose one of these brokers after properly evaluating the two platforms. After all, traders have their own needs and preferences.

(Risk warning: Your capital can be at risk)

Frequently asked questions about the Exnova and Binomo comparison:

Are Binomo and Exnova good trading platforms?

Exnova and Binomo are good trading platforms for any trader. These brokers offer traders a platform where they can begin trading with a low minimum deposit and enjoy good features. The asset offerings on the two platforms are also satisfactory. So, traders can consider these platforms good.

Which broker has an easy signup process – Exnova or Binomo?

Both online trading platforms have a simple signup process. It takes traders only a few minutes to have their trading accounts ready with both brokers.

What is the minimum deposit on Binomo?

Traders must fund their Binomo trading account with a minimum deposit of $10.

Do Exnova and Binomo offer good customer support?

Yes, Exnova and Binomo both offer great customer support for traders. In addition, customer support can help them overcome any problems they might encounter while trading.

Which broker has a wider range of asset offerings, Exnova or Binomo?

Exnova has a wider range of asset offerings, providing over 250 financial instruments, compared to Binomo’s 75+ assets.

How do the withdrawal fees of Exnova and Binomo compare?

Exnova offers one free withdrawal every month and charges a 2% fee on subsequent withdrawals in the same month, whereas Binomo applies a withdrawal fee on all withdrawals.

Do both Exnova and Binomo offer automated trading options?

Yes, both Exnova and Binomo offer bots for an automated trading experience, with Exnova offering a bot and Binomo offering BinomoBot.

Which platform is more suitable for traders concerned about high withdrawal fees?

Exnova is more suitable as it offers one free withdrawal every month and has lower withdrawal fees compared to Binomo, which charges fees on all withdrawals.

How do the account types of Exnova and Binomo differ?

Binomo offers multiple account types including Standard, Gold, and VIP, catering to different traders, whereas Exnova offers only one type of account, limiting the options for traders.

Tip: You may also want to check out our other comparisons:

]]>Among all brokers in the trading world, Exnova offers a secure and reliable online trading platform to traders. It has a simple user interface. So, traders can access the platform and trade from over 250 that it offers.

Traders do not usually encounter any issues while trading on Exnova. However, sometimes traders might find themselves stuck and need Exnova’s support.

Gladly, the broker has 24×7 customer support open for traders. Traders can communicate with the broker using different channels. Here, we will discuss how a trader can contact Exnova customer support in case of any problems.

(Risk warning: Your capital can be at risk)

What you will read in this Post

Different ways to contact Exnova:

Traders can connect with the broker using the following channels:

- Phone

- Live Chat

Where is Exnova based?

Exnova belongs to the parent company Digital Smart LLC. This company has its head office in St Vincent and the Grenadines. The broker offers multiple trading features and tools to traders. Even though Exnova is of recent origin, the broker has become famous among investors.

Traders can follow the best trading practices on the platform and make massive profits. In addition, the broker offers numerous trading options to traders. For instance, traders can trade binary options, digital options, stocks, commodities, indices, and forex.

Trading these assets using the easy interface of Exnova is simple. However, sometimes, traders might be confused about using the trading platform. In such cases, the broker allows traders to connect with Exnova support. So, let’s discuss how traders can do it.

(Risk warning: Your capital can be at risk)

How to connect with Exnova?

Exnova offers a streamlined procedure that allows traders to connect with the broker. Once traders log into their Exnova trading account, they can click on chat support.

The chatbot will assist traders in resolving any problems that might pop up while trading.

Traders can type in their queries about trading, and the chatbot will offer instant solutions. However, sometimes the chatbot might not be able to resolve your query. The bot will ask you to connect to the customer support executive in such cases. You can send the confirmation to the chatbot to connect you with customer support.

The support team will help you 24/7 with any questions you may have. So, traders can trade seamlessly on the trading platform.

Assistance through email

Besides chatting with customer support or the chatbot, traders can connect with Exnova’s team through email. If you open the broker’s website, you will find the email address listed. Traders can send an email to support@exnova.com.

Using the “support” function is very convenient because traders always have questions. Usually, the broker takes up to 24 to 48 hours to revert to your inquiry.

Assistance through social media

Exnova is also available on several social media networks. Traders can post their queries or problems on the social networking pages of the broker. The broker will give traders a direct response on the platform they are using.

(Risk warning: Your capital can be at risk)

Is it worthwhile to join Exnova?

Exnova is a worthwhile online trading platform. It is full of features that allow advanced and beginner traders to trade without hassle.

Several trading tools, instruments, etc., are available to traders for trading. You can enjoy implementing these features and building trading strategies that work wonders for them. The broker also has a good customer support team that allows traders a seamless trading experience. So, using the Exnova trading platform is worthwhile for any trader.

Conclusion – Contact the support team of Exnova

No matter if you have an Exnova VIP account or not – The broker treats every trader great and offers its remarkable services to hundreds of people around the world. Traders can access the Exnova trading platform in different countries and multiple languages. If you as a trader trade on this platform, you have many opportunities. Traders can get a free Exnova demo account to practice their skills.

Apart from this, the brokers offer the best customer support to traders. Traders can contact the broker via different modes. So, traders can consider using this online platform to trade their favorite assets, including their popular Exnova OTC assets and many more.

(Risk warning: Your capital can be at risk)

Frequently asked questions about trading with Exnova:

What is Exnova support?

Exnova support is a customer support service provided by Exnova for traders who find themselves stuck while trading on the platform.

What types of support does Exnova offer?

You can contact the operator, by writing an e-mail. You can call them on or use live chart. By the way, they also have a knowledge base and FAQs section on their website, which can provide traders with helpful information and guidance.

How can I contact Exnova support?

Traders can contact Exnova support by phone, email, or live chat. The broker’s contact information is listed on their website.

What is the response time for Exnova support?

The response time for Exnova support may vary depending on the issue. Typically, they aim to respond to customer inquiries within 24 hours. However, the broker may take longer during peak periods or for more complex issues.

Does Exnova offer 24/7 support?

Exnova offers 24/7 chat support to traders support. So, traders can connect with the broker anytime they have an issue while trading.

Exnova and Olymp Trade can be the perfect choice to trade binary options, digital options, cryptocurrencies, etc. This is because these trading platforms have good trading conditions. In addition, both platforms have simple and user-friendly interfaces and are popular with many traders.

As both trading platforms are equally popular for their high-quality features, traders often find it difficult to decide which platform to use. This Exnova vs. Olymp Trade guide will help you choose a broker that suits your trading preferences. Let us evaluate the two brokers from different perspectives to make the choice easier for you.

Exnova vs. Olymp Trade – A full comparison of all features

Exnova vs. Olymp Trade are different in many ways. Here we look at what traders look for in a broker.

| Basis | Exnova | Olymp Trade |

|---|---|---|

Rating (based on this comparison): Rating (based on this comparison): |

8.5/10 | 7/10 |

Minimum deposit: Minimum deposit: |

$10 | $10 |

Minimum trade value: Minimum trade value: |

$1 | $1 |

Deposit and withdrawal methods: Deposit and withdrawal methods: |

Bank transfers, credit cards, debit cards, electronic wallets | Bank transfers, credit cards, debit cards, electronic wallets, cryptocurrency |

Asset available: Asset available: |

250 | More than 75 |

Withdrawal fee: Withdrawal fee: |

Applicable after one free withdrawal after every month | Free withdrawals |

Bonus: Bonus: |

No | Sign-up and deposit bonuses are available |

Customer support: Customer support: |

24×7 support | 24×7 support |

Education and research: Education and research: |

Yes | Yes |

Demo account: Demo account: |

Free demo account | Free demo account |

(Risk warning: Your capital can be at risk)

(Risk warning: Your capital can be at risk)

#1 Minimum deposit

Traders often want to join a trading platform that does not have a very high minimum deposit amount. A low minimum deposit amount is the least amount a trader should fund in his trading account.

Exnova and Olymp Trade have the same minimum deposit amount. Both brokers allow traders to initiate trading with $10.

| Specification: | Exnova | Olymp Trade |

|---|---|---|

| Rating (based on this comparison): | 8 / 10 | 8 / 10 |

| Minimum deposit: | $ 10 minimum Exnova deposit | $ 10 minimum Olymp Trade deposit |

| Deposit/withdrawal fees: | No | No |

| Payment methods: | Credit cards, cryptocurrencies, local bank transfers, electronic wallets | Credit cards, cryptocurrencies, local bank transfers, electronic wallets |

| Withdrawal duration: | Maximum 3 business days (often after a few hours) | Maximum 3 business days (often after a few hours) |

#2 Minimum trade

Some brokers have very high minimum trade requirements. Therefore, such trading platforms are a big no-no for traders. However, both brokers allow traders to trade with as little as $1.

Traders looking for a platform that allows them to start trading with a small amount of money can choose either of these two brokers.

| Specification: | Exnova | Olymp Trade |

|---|---|---|

| Rating (based on this comparison): | 8 / 10 | 8 / 10 |

| Minimum trade: | $ 1 | $ 1 |

#3 Demo account

A demo account is there to practice trading.

Traders also need a trading platform to build their trading strategies. Exnova and Olymp Trade both offer traders a free demo account. Traders can sign up for the Exnova demo account or the Olymp Trade demo account and use it for free for 30 days.

The two brokers offer traders virtual funds in their trading accounts. This gives them almost $10,000 in virtual funds that they can use to practice trading.

| Specification: | Exnova | Olymp Trade |

|---|---|---|

| Rating (based on this comparison): | 9 / 10 | 7 / 10 |

| Demo account: | Available | Available |

| Virtual funds: | $10,000 | $10,000 |

| User-friendliness: | Excellent | Good |

| Duration: | 30 days | 30 days |

#4 Deposit and withdrawal durations

There are several deposit and withdrawal methods available on these two platforms. Exnova and Olymp Trade offer fast deposits for traders. For example, they can transfer money by bank transfer, e-wallet, credit card, or debit card.

While deposits are fast on both trading platforms, withdrawals can take some time. Compared to Exnova, Olymp Trade has a longer withdrawal time.

| Specification: | Exnova | Olymp Trade |

|---|---|---|

| Rating (based on this comparison): | 10 / 10 | 6 / 10 |

| Deposit duration: | 1-3 business days | 1-3 business days |

| Withdrawal duration: | 1-3 business days | 1-3 business days |

| Payment methods: | Credit cards, cryptocurrencies, local bank transfers, electronic wallets | Credit cards, cryptocurrencies, local bank transfers, electronic wallets |

#5 Asset offering

Traders should rely on a trading platform that has a large number of assets to trade. When a trader gets many assets, they can manage their risk more effectively. There are over 250 assets on Exnova. This makes it a better trading platform than Olymp Trade.

Olymp Trade offers traders almost 75+ underlying assets to trade. Therefore, traders who want a trading platform that offers them more assets should choose Exnova over Olymp Trade.

| Specification: | Exnova | Olymp Trade |

|---|---|---|

| Rating (based on this comparison): | 9 / 10 | 5 / 10 |

| Return on investment: | Up to 100% | Up to 92% |

| Binary Options: | Yes | Yes |

| Forex / CFD Trading: | Yes | Yes |

| Assets: | 250+ (crypto, currencies, stocks, indices, commodities) | 75+ (crypto, currencies, stocks, indices, commodities) |

| OTC trading: | Yes | Yes |

| Trade execution: | 0,5 ms | 0,5 ms |

| Margin trading: | Available | Available |

#6 Withdrawal fees

There are no hidden charges for your transactions. This is a major advantage of Olymp Trade.

No trader wants to sign up to an online platform that charges a withdrawal fee. We all love free withdrawals. If you do, then Olymp Trade is the perfect platform for you.

However, when you trade with Exnova you will be charged withdrawal fees of around 2% per withdrawal. Exnova only allows one free withdrawal per month. After your first withdrawal, the broker will charge an Exnova fee for withdrawals depending on the currency and payment method.

| Specification: | Exnova | Olymp Trade |

|---|---|---|

| Rating (based on this comparison): | 6 / 10 | 10 / 10 |

| Withdrawal fees: | 2% per Exnova withdrawal, 1 free withdrawal per month | No Olymp Trade withdrawal fees |

#7 Bonus

There is no mention of bonuses on Exnova. So if you get a bonus with Exnova, consider yourself lucky. On the other hand, signing up with Olymp Trade can be a good choice for traders looking for a broker that offers bonuses.

Olymp Trade offers traders sign-up and deposit bonuses. Deposit bonuses can be almost 30% of the amount you deposit into your trading account.

| Specification: | Exnova | Olymp Trade |

|---|---|---|

| Rating (based on this comparison): | 0 / 10 | 8 / 10 |

| Deposit bonus: | / | Up to 110% Olymp Trade bonus for deposits (depending on the account type) |

| Sign-up bonus | / | Up to 30% |

| Risk-free bonus: | / | Available |

| Balance bonus: | / | / |

| Percentage of turnover bonus: | / | / |

| Bonus turnover: | / | No bonus turnover |

| Free lottery: | No | No |

#8 Customer support

Exnova and Olymp Trade have a customer support system that is always ready to help traders in times of need. The brokers offer 24×7 support to traders who experience problems while trading online. This support is available in several languages.

Traders can contact customer support through various channels on both trading platforms.

| Specification: | Exnova | Olymp Trade |

|---|---|---|

| Rating (based on this comparison): | 10 / 10 | 10 / 10 |

| Support availability: | The Exnova support is available 24/7 | The Olymp Trade support is available 24/7 |

#9 Regulation

When comparing the regulatory aspects of Exnova and Olymp Trade, it’s important to note that regulation is a crucial element of trust for traders in the brokerage industry. Exnova, operated by Digital Smart LLC, does not disclose any regulatory oversight on its website, leaving its regulatory status unclear. In contrast, Olymp Trade is a member of the Vanuatu Financial Services Commission (VFSC), which provides traders with a degree of security and arbitration.

Now, let us take a closer look at the regulation of both platforms.

| Specification: | Exnova | Olymp Trade |

|---|---|---|

| Rating (based on this comparison): | 8 / 10 | 10 / 10 |

| Regulation: | Not mentioned on their site | Vanuatu Financial Services Commission (VFSC) |

| European Regulation: | No | No |

| US Regulation: | No | No |

| Other regulators: | / | / |

#10 Auto trading

When it comes to automated trading with binary robots, Olymp Trade clearly offers a more robust suite of tools than Exnova. Olymp Trade has built-in digital assistants such as Advisors, which track chart behavior to find optimal trade entry points, and can be combined with various strategies such as MACD Professional and Predatory Look. In addition, Olymp Trade provides an Insights tool for fundamental analysis and up-to-date asset reviews, alerting traders to potential market opportunities. The platform also includes Automated Advice for real-time data crucial for day trading, allowing traders to quickly switch between trading modes and view price movements.

In contrast, Exnova falls short as it lacks integration with advanced automated trading platforms such as MT4 and MT5, which are essential for traders looking to use automated trading suites. Exnova does offer a mobile application for managing trades on the go, but this does not make up for the lack of sophisticated automated trading features offered by Olymp Trade.

| Specification: | Exnova | Olymp Trade |

|---|---|---|

| Rating (based on this comparison): | 0 / 10 | 7 / 10 |

| Auto Trading: | Not available | Available |

What is Exnova?